Space & People : Trading Update & New Contract

The RNS released this morning looks interesting...

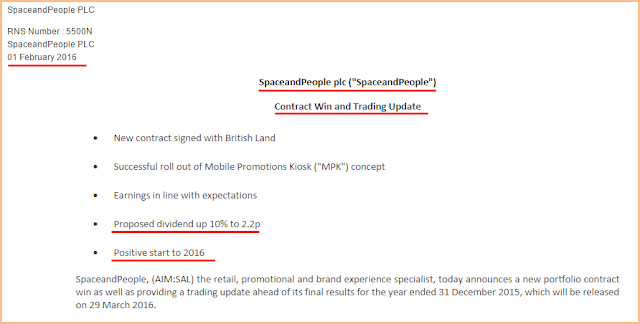

Summary of RNS Text...

New Contract Signed

- SpaceandPeople has signed a multi-year contract, which commenced on 1st January 2016, to manage promotional space at British Land's Drake Circus Shopping Centre in Plymouth. SpaceandPeople expects to extend this contract across 40 other assets, covering the majority of British Land's multi-let retail portfolio in due course.

- With a high quality vision for their venues, British Land has chosen SpaceandPeople based on the company's track-record in brand experience and outdoor marketing.

- Retail assets in the portfolio include Meadowhall, Sheffield; Ealing Broadway, London; Old Market, Hereford; Glasgow Fort, Glasgow; Fort Kinnaird, Edinburgh; Teeside, Stockton-on-Tees; Broughton, Chester; and New Mersey, Speke.

Matthew Bending, SpaceandPeople CEO, said:

"This is a significant win for SpaceandPeople, and will complement our existing business. Our team has a wealth of knowledge and we are looking forward to supporting British Land's vision of 'Places People Prefer' across the UK."

Trading Update

- Trading in the second half of 2015 was in line with management expectations. Management expects profit before tax attributable to shareholders for the year to be approximately £1.0 million. Whilst this is slightly below current market expectations, the principal reason for this is due to a timing difference following a decision to recognise an element of promotional revenue that is now derived from Mobile Promotions Kiosks ("MPKs") on the same basis as we recognise revenue from Retail Merchandising Units. This change has resulted in the deferral of £150k of net promotional revenues from 2015 to 2016. The decision to account for revenue in this manner gives management better sight of future revenue and will be the standard accounting treatment applied to this type of revenue going forward.

- During 2015 the new MPK concept was rolled out as planned with 46 units operational by the end of the year. A decision was also taken to accelerate our investment in France during the final quarter of 2015, in advance of the Immochan contract start date of 1 January 2016, which is expected to help drive revenue more effectively.

- Despite these decisions, basic EPS is expected to be in line with market expectations at 4.3p and as a result, the Board intends to propose a final dividend of 2.2p per share at the forthcoming Annual General Meeting. This is a 10% increase on the 2.0p dividend paid in April 2015.

- After the investment of £650k in MPKs during 2015, net cash as at 31 December was £0.75 million plus an additional £400k held in escrow (2014: £1.6 million).

--------------------- End of RNS Summary --------------------------------------------------------------

This could be of interest to us DIY-Investors... what do you think?

Mick (1st February 2016)

When SAL signed contract with Network Rail for 5 years (no value mentioned)share price went up as high as 81p!! With this additional contract with British Land.....'A significant win'.....management is confident....increasing dividends....all good signs for future!

ReplyDeleteI agree... when the market is turbulent and good news comes out, any price move can be suppressed for a while. In the long-term however, this seems to be worth a very close look! Mick.

ReplyDelete