Thorntons (LSE: THT) : SP=47.75p, MCAP=£32.6m

Thorntons released its interim results today, showing some positive signs that it's shift away from 'own shop' retail sales to distribution through supermarket and other established retailers is starting to work.

Key Financial Points are:

· Revenues up 2.9% to £133.7 million (2012: £130.0 million).

· Profit before tax (PBT) and exceptional items rose by £2.2 million to £5.3 million (2012: £3.1 million).

· Profit after tax rose by 49.3% to £4.0 million (2012: £2.7 million)

· Exceptional items total £0.7 million (2012: £2.4 million) consisting of impairment and onerous lease provision movements.

· Cash generated from operations £15.0 million (2012: £11.6 million).

· Net debt up slightly, at £17.5 million (2012: £16.2 million).

· No interim dividend (2012: Nil).

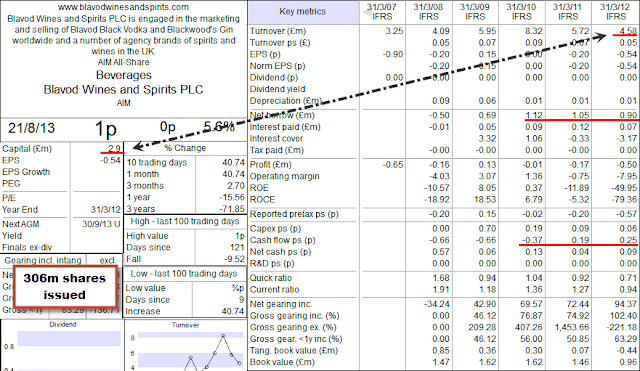

Technical Analysis

The share price graph (above) seems to show that the recovery is progressing well. It will be interesting to see if the steady decline, between February 2011 and November 2011, is matched on the recovery by a steady rise. There doesn't seem to be any technical barriers to indicate sticking points as THT progresses through 2013.

Key Metrics

With the PSR at 0.15, there would appear to be scope for the return to profit being rewarded by a re-rating over the coming months.

What do you think?

Mick.

P.S. Pass the chocolates!