Last Call - Join Us At DIY-Investors This Evening at 8pm

If you haven't already done so, you will need to register for the Free Webinar this evening (starting at 8pm BST).

Topics Include:

- Getting Started (as a DIY-Investor)

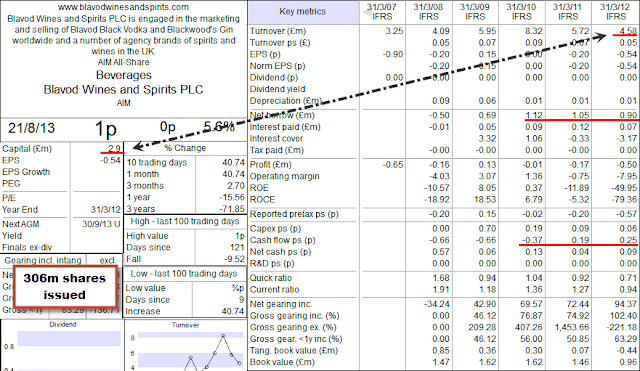

- Review of two popular (paid) investing tools

- Three excellent free sources of information

- How one of the DIY-Investors Portfolios doubled in 19 months

- When to Buy, Hold or Sell (examples)

- A simple Routine

- How Can DIY-Investors Help?

There are only a few places left, so hurry! - Register HERE